You hear people mention the word “estate” almost every day, but do you really know the meaning behind the word estate? Well, if you don’t, you are about to find out. An estate is simply the net worth of an individual at a certain point in time. Your estate can be your assets, that is, those cars of yours, your insurance, stocks, investments, and houses- generally anything that is valuable.

When you kick the bucket, no one will bury those cars and houses you left behind with you. All your assets will be left in this world while you move over to the next. So, if you planned your estate before your demise, your assets will be distributed according to your wish, but if you don’t, the government will dictate everything regarding your estate.

What is Estate Planning?

From the definition of an estate, you should have a little insight into what estate planning entails. Well, estate planning is a very common word which you find on the lips of people with an estate. Estate planning involves plans regarding how the assets or properties of a deceased person will be distributed, managed and preserved. It also involves the management of the deceased properties including financial commitment, should they become incapacitated. The assets that constitutes a person’s estate are cars, houses, jewelries, pensions, etc. Upon the death of the individual, these assets are shared according to his or her wish which will be documented in a will.

Some years back, there was the misconception that estate planning was meant for the rich. That is not the case. Estate planning is for everyone, the poor and the rich.

Individuals make estate plans for lots of reasons. It could be to preserve their family wealth, to provide funds for their families and loved ones when they die, to fund the education of their children, etc. Estate planning is important, if you cared about those you’ll leave behind when you finally kick the bucket.

One mistake you shouldn’t make while alive is the mistake of failing to plan your estate. You never know, tomorrow you may be no more. If you die without planning your estate, your properties will be shared by the state government. This process can be ugly, long, and very expensive. You wouldn’t definitely want those you left behind to go through such after having to deal with your demise. So ensure you plan your estate while you still breathe, you never can tell if you will be alive tomorrow.

Estate Planning Attorney Fees

Estate planning attorney fees varies and depends on several factors such like the type of plan needed and the billing method of the attorney. Other factors are the experience level of the attorney, the state the plan is being created, the complexity of your estate plan, including the value of all that you own (your assets or estate).

Also, the cost of hiring an estate planning attorney hinges on the location, fee arrangement, the expertise of the attorney, etc. Generally, you will need from $200 to $2,000 to hire a state planning attorney, though this depends on the circumstances surrounding your estate.

When hiring an estate planning attorney, ensure you go for one that meets your budget. Not all competent estate planning lawyers boast of high hiring fee, you can get a good estate planning lawyer for a considerable amount of money if you do your homework well.

Estate Planning Lawyer

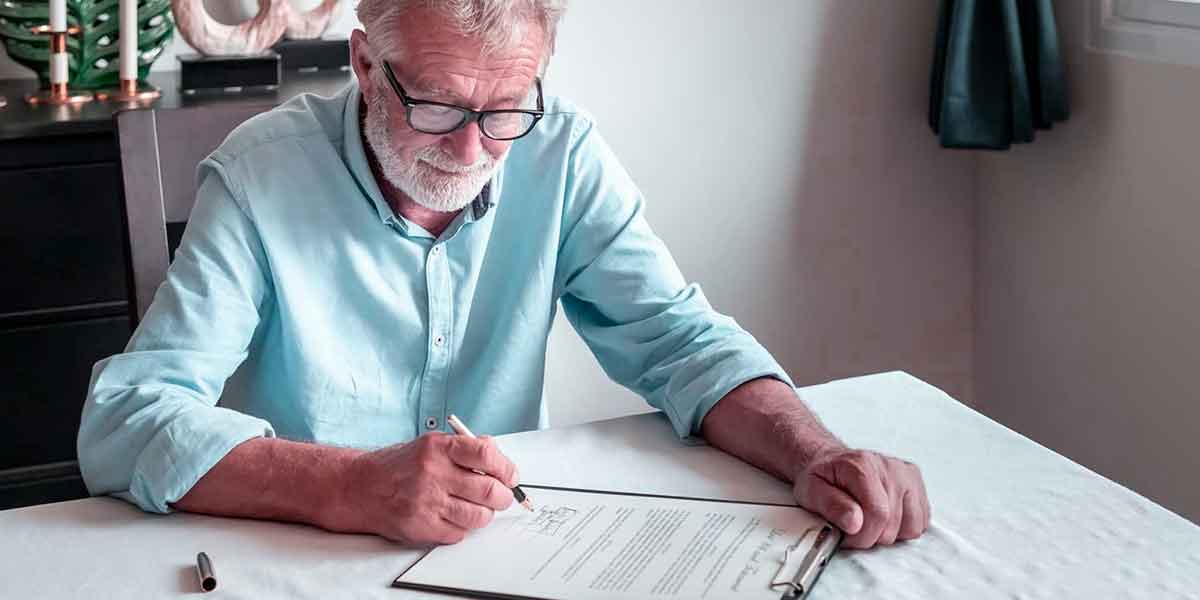

Estate planning can be a tough task, depending on how you want your estate to be planned. To ensure that your estate is well planned, it is best you contact a professional, one who is quite conversant with estate planning and the estate planning laws of the state you reside in. Also, ensure you hire a lawyer who is compassionate enough, one who you can trust.

If you reside in the city of Miami and you need help regarding the planning of your estate, you can contact an estate planning lawyer in Miami. Always ensure that whoever you hire, is competent and trusted.